Breaking Europe’s emerging CO2 storage monopoly

Written in collaboration with Eadbhard Pernot, policy manager for carbon capture at Clean Air Task Force and Lina Strandvåg Nagell, senior manager projects & EU policy at Bellona.

Making Europe’s climate goals a reality will mean delivering CO2 storage capacity on a large scale. As made clear by all leading scientific assessments to reach climate neutrality, most recently the European Scientific Advisory Board on Climate Change, carbon capture and storage (CCS) is critical to reach net-zero emissions.

However, as projects begin to reach the investment and construction phase, a worrying picture is beginning to emerge: European CO2 storage is at risk of becoming monopolised by countries on the North Sea, prioritising their own national economic interests, putting at risk the decarbonisation of Southern and Eastern Europe.

CO2 storage: A climate and economic resource

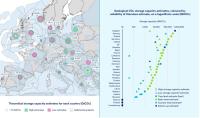

As European industries look to meet their climate targets, emitters across the region are in need of access to CO2 storage. Luckily, the vast majority of European countries seem to have good potential for CO2 storage.

Harnessing the potential of these resources, by turning them into operational sites, will be critical to reach the EU’s climate targets and retain European industries.

Developing a European CO2 infrastructure network will inevitably come at considerable financial cost. But a well-planned European approach to building this network can make this cost much lower than it would otherwise be, taking into account social acceptance and regulatory obstacles.

Until dedicated CO2 transport networks are developed, transporting large volumes of CO2 across long distances can be prohibitively expensive for industry – potentially five or six times the cost of storing the CO2 nearby.

The best option to reducing these costs may simply be to build more storage sites closer to emitters and industrial hubs. In fact, a Clean Air Task Force analysis shows that doing so might cut the costs of CCS in Europe by up to two-thirds.

However, current project developments across Europe show a worrying picture: The emerging CO2 storage market is becoming increasingly controlled by a North Sea monopoly.

While the development of storage in the North Sea is a positive development, an imbalance in CO2 storage development in Europe presents a significant risk to European industries, particularly those in central, eastern and southern Europe, as the cost would be prohibitively expensive.

Net Zero Industry Act: A chance to break the North Sea monopoly

Making Europe’s climate goals a reality will mean overcoming significant hurdles: none more so than developing CO2 storage infrastructure. As the Commission made clear in its proposal for a NZIA in March, “a key bottleneck [to scaling CCS] is the availability of operating CO2 storage sites in Europe”.

To solve this issue, the NZIA sets a target of 50 million tonnes of CO2 storage capacity per year by 2030 – a sizeable amount, considering there are currently no operational CCS projects in the EU, despite a clear demand, with up to 60 million tonnes per year of announced capture projects in the EU right now.

The NZIA proposes various measures to unlock the storage barrier, including making Member States provide transparent data on their potential to develop storage sites, as well as accelerating the delivery of storage permits.

The assignment of responsibility to oil and gas producers in the EU by linking to their share of production, is a key measure to force the industry to take action after so many years of talk.

Article 18 of the NZIA will force the industry to stop simply talking about CCS and invest in storage capacity, based on a pro rata share of the fossil fuels they produce between 2020 and 2023.

This obligation has already been welcomed by a number of organisations including the oil and gas industry, who last year called on the EU to set a European ambition for CO2 storage capacity between 0.5-1 billion tons of CO2 storage capacity per year by 2050.

Creating a competitive CO2 storage market

Developing CCS will require a mixture of both sticks and carrots. While attention must be paid across the full value chain, operational storage capacity is a major bottleneck for European industrial decarbonisation. Strong regulatory requirements like an obligation to build CO2 storage are needed to make the oil and gas industry act now.

These requirements are far from a harsh punishment for the industry. As the Commission identified in June, the potential economic value of the future CO2 value chain in the EU stands between €45-100 billion. Moreover, a CO2 storage obligation on the industry does not prohibit other free market operators to contribute to establishing CO2 storage sites.

But as policymakers in Brussels continue their negotiations on the Net Zero Industry Act, some member states, particularly those seeking to corner the EU CO2 storage market for themselves, are the ones standing in the way of the obligation on oil and gas producers.

For some member states, it’s in their interests to cement the status quo and take a large share of CO2 storage capacity, enabling higher tariffs to be charged to industry.

For example, a study commissioned by the Danish Energy Agency outlined that approximately €36 billion in revenue could be earned through imports of CO2 of up to 40 Mt/yr with a payback time of just 11 years. This concentration of storage resources poses significant risks to the EU Single Market.

The CO2 storage obligation offers a way to alleviate these risks by enabling storage access in more member states since it will require large producers to take on more of the costs and risks of project construction. This will ease the burden on taxpayers in Member States looking to decarbonise their industries with CCS.

As negotiations on the EU Net Zero Industry Act continue, EU Member States, particularly Southern, Central and Eastern member states should take note of this. Without access to affordable CO2 storage, their industries face an existential threat.

To ensure that CCS does not become centralised in the North Sea and emissions are eliminated at the lowest cost possible across the EU, policymakers need to take action with the Net Zero Industry Act now.

Published in EURACTIVE on the 18th of October 2023.